Astroport Incentive Framework

Overview

This proposed Astroport Incentive Framework described here for Astroport aims to achieve several goals:

- provide a blueprint for anyone to submit ASTRO emissions proposals which comply with guidelines accepted by the community

- serve as a guide to adjust ASTRO emissions for all pools that are currently incentivised

- balance the value of the fees generated by each incentivised pool with the value of the ASTRO given out in the form of emissions

The Astroport Incentive Framework is crucial to ensure the community has ample reserves which can be used for emissions as well as balance these emissions with fees generated by each pool. By standardising the way the community analyses emissions proposals, they can more easily make decisions on how to optimally use ASTRO emissions. We can also avoid the potentially political process of choosing which pools get incentivised and how much ASTRO each of them gets.

Criteria for Existing & New ASTRO Emissions

Major assets

When defining the criteria below we distinguish between major and non-major assets in recognition that some assets have more strategic importance to Astroport than others. A major asset is defined as one that satisfies all of the following conditions:

- Top 200 token market cap

- Of special strategic interest to Astroport

- Majority of trade volume occurring outside of Astroport

Note in the case of Axelar assets we consider them equivalent to their non Axelar counterparts, e.g native USDC.

This categorization was inspired by a governance proposal on Osmosis.

Criteria

Each and every current and future ASTRO emissions proposal should meet all of the following criteria:

- The pool has been trading on Terra 2 mainnet (Phoenix network) for at least 4 weeks

- LPs in the pool should already receive token emissions (using the Astroport dual reward feature), unless the pool is comprised of two major assets (see definition above) or one major asset where the other is ASTRO

- Dual rewards should continue for at least 4 weeks from the moment (and in case) the Assembly passes a vote to direct ASTRO emissions to the pool

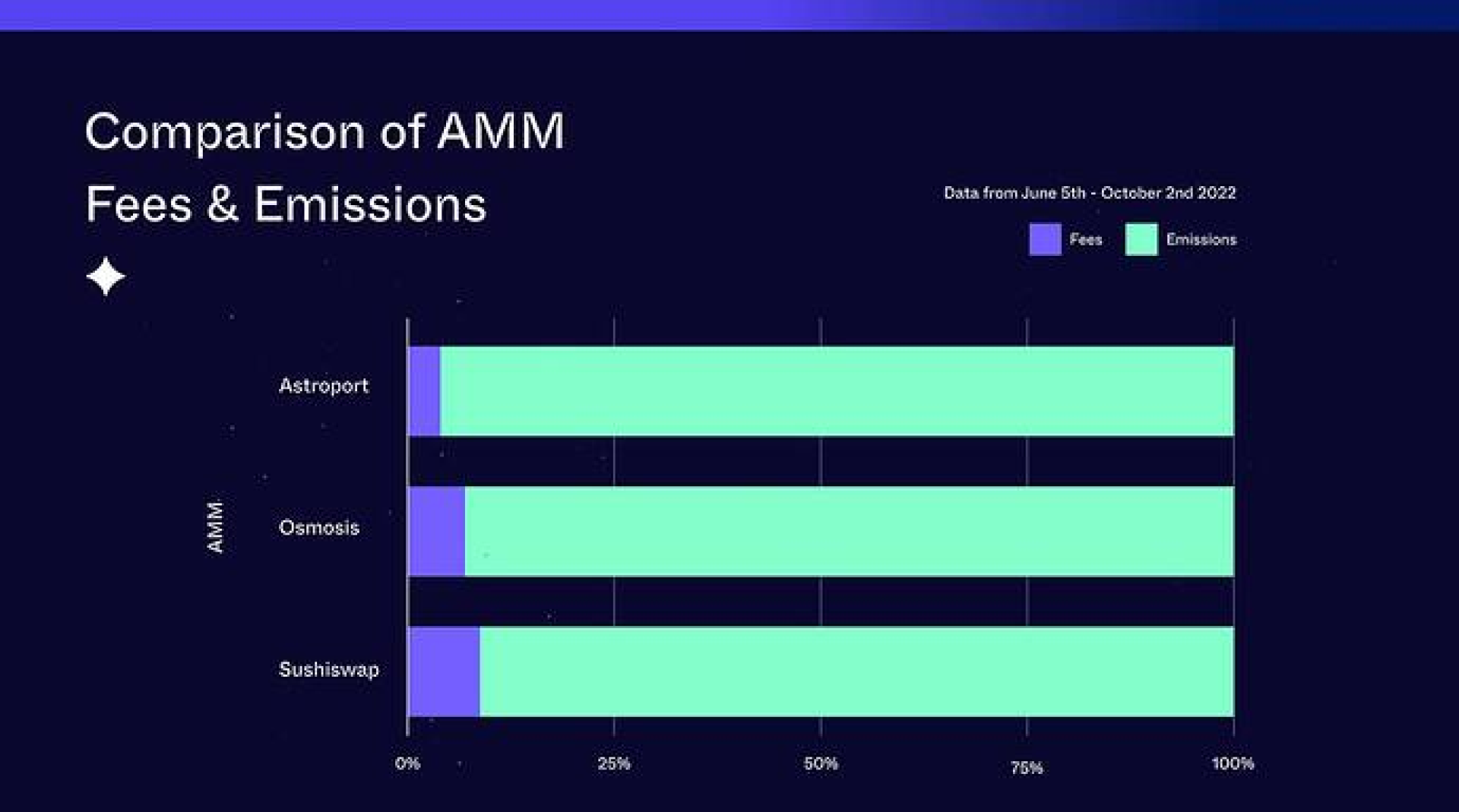

- The target ratio of fees to incentives should be 0.1, in line with those of Osmosis and Sushiswap as shown above

Besides the above criteria, we propose the following framework to periodically re-evaluate current pools that receive ASTRO emissions:

- All emissions should be reviewed every 8 weeks. This includes reviewing pool performance (in terms of volume and thus generated fees) and third-party incentives

- A pool should only increase or decrease its percentage of ASTRO emissions by 25% at a time (in a proposal posted every 8 weeks). For example, a pool that’s currently receiving 100K ASTRO per year can only increase its emissions by maximum 25K ASTRO (for a total of 125K ASTRO per year)

Exceptions

Based on this framework both ASTRO-LUNA and ASTRO-axlUSDC should receive incentives. However, the Assembly proposed that ASTRO pairs be treated differently from other pairs with the following justification.

It is beneficial to Astroport for the ASTRO token to have deep liquidity. Firstly, this is necessary for those seeking to participate in governance to swap in and out of the ASTRO token. Secondly, an illiquid ASTRO token would result in volatile price spikes for pool incentives, making them hard for LPs to estimate. It is also not desirable or necessary to fragment liquidity by incentivising multiple ASTRO pairs.

To satisfy this, the Assembly proposed that the ASTRO-axlUSDC pair receive ASTRO incentives, while the ASTRO-LUNA does not. Additionally the amount of incentives are to be set separately and for now will remain unchanged.